Is your product mix still fit for purpose?

When did you last review your product mix?

When did you last review your product mix? If it was a couple of years ago, it may well be time to review again. Whilst some organisations are good at monitoring sales of product by volume and value on a regular basis, many clubs, pubs and restaurants “set and forget” their product mix for months, even years at a time.

Tastes change all the time and to keep relevant to your customers and local market, you need to ensure you are monitoring and managing the changing tastes. I am old enough to remember when all beers were ‘full strength’ and we almost laughed (and choked) when some ‘low alcohol’ beers were first introduced in the 1980s – Vale Tooheys 2.2 and Swan Special light.

Fast forward to the 2020s and the Mid-Strength and Low-Strength beers hold about 25% of the total volume of the beer market. Add in the search for healthier Low-Carb options and the combined Mid-Strength/Low-Carb beers and the stats say around 30% of beer drinkers are looking for this option. (PW Consulting Dec 2024)

Now add in Zero Alcohol Beer and you have one of the fastest growing segments in the market in Australia, growing by 9.3% in 2023-24 against a nearly flat growth regular beer market.

According to a Wine Australia Article in February 2025, globally over the five years to 2023 no-alcohol wines have grown 13 percent per annum and low alcohol wines grew 21 percent per annum. Whilst still a relatively small segment, the interesting point is this level of growth in a market that declined three percent overall over the same five year period.

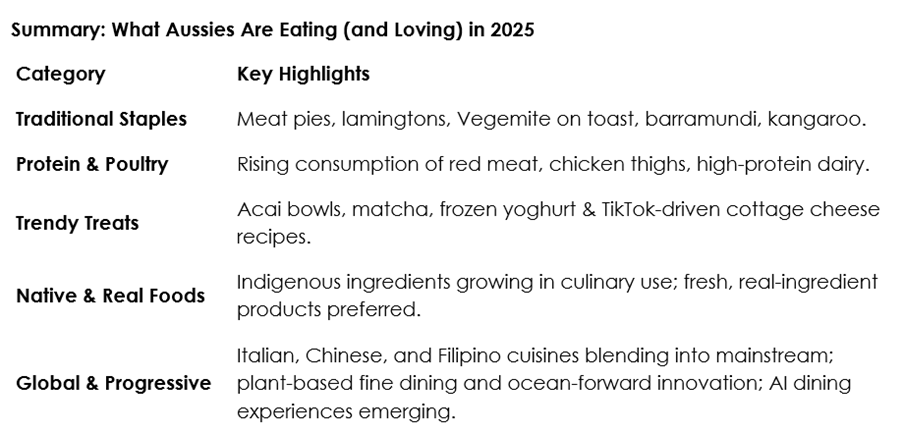

Food – the number one driver into clubs and pubs, and restaurants obviously – tastes are changing too. Taste Magazine, in March this year, reviewed the most popular cuisines for people to cook at home and also their popular choices for eating out. Summarised in the table below are the trends for 2025:

Review and Refresh

So, all this begs the question – when did you last review and refresh your product offering? Included in the review, amongst other issues, has to be:

x Demographic change – has your market changed significantly on age, gender, ethnicity, religion and food or drink preferences?

x Competition change – have new outlets for food opened up recently and been wildly successful with their offering e.g. Zeus Greek Street Food some years ago – or has someone has reinvented a classic e.g. Grilled and the humble hamburger.

x Dietary trends – over the past couple of decades vegetarian, and particularly Vegan requirements, have really created a presence in the market, not to forget dairy and gluten intolerances that are daily challenges for chefs in their kitchens.

And if you have a point of sale (POS) system, and you are not regularly extracting top 20 and bottom 20 products, you are missing some of the key benefits of the POS. If food and beverage products are stagnant or declining in sales, you need to ask Why and What should we do about that? If promotion has been lacking for any particular products, a small reminder promo may revitalise an old favourite and if not, at least you will reduce stock levels that can facilitate product deletion.

If you introduce a new product or product line, monitoring the sales by volume and value can be a great indicator of uptake, and match to your customer’s tastes. Be aware that venues differ and a wildly popular product in a competitor’s venue may not translate into wild popularity in your venue. But you have to try and see the results to keep up to date with those trends and changing tastes.

Set some sensible parameters around trial periods of new products, to give them a fair chance to take off or crash. Ensure your staff are all informed of the program behind product revitalisation or launch, so they know what they need to push. Internal marketing communications (video screens, till screens and the like) need to support the product push and of course, so too does your website and social media communications.

This is paragraph text. Click it or hit the Manage Text button to change the font, color, size, format, and more. To set up site-wide paragraph and title styles, go to Site Theme.

This is paragraph text. Click it or hit the Manage Text button to change the font, color, size, format, and more. To set up site-wide paragraph and title styles, go to Site Theme.